The sixteenth meeting of the Conference of the Parties to the UN Convention on Biological Diversity (COP16) opened in Colombia on October 21 for a 12-day session. During a side event, the “Kunming-Montreal Global Biodiversity Framework: Potential OECM Cases in China,” supported by Huatai Securities (Stock Code: 601688.SH, 6886.HK, HTSC.L), was presented to showcase China’s diverse approaches to balancing ecological protection with socioeconomic development. On October 25 (local time), Huatai Securities, together with the Shan Shui Foundation, announced the launch of China’s first OECMs special fund at COP16. The fund will provide practical and sustained support to qualified potential OECM cases, aiming to accelerate the mainstreaming of biodiversity conservation among diverse stakeholders. The Shanghai Stock Exchange Foundation will also provide charitable support for this initiative.

The launch of the OECMs special fund was attended by Jillian Campbell, Representative of the UN Convention on Biological Diversity Secretariat; Liu Ning, Deputy Director General of the Department of Nature and Ecology Conservation of China’s Ministry of Ecology and Environment; James Hardcastle, Head of the Protected and Conserved Areas Team at the International Union for Conservation of Nature (IUCN); and Lu Zhi, Boya Distinguished Professor at Peking University and Board Member of Shan Shui Foundation.

In 2022, as the COP15 presidency, China played a key role in promoting the ambitious yet practical “Kunming-Montreal Global Biodiversity Framework.” This framework introduced the “30×30” target, which aims to protect at least 30% of the world’s terrestrial, inland waters, coastal, and marine areas by 2030. Since officially designated protected areas alone cannot achieve this target, other effective area-based conservation measures (OECMs) with broad social participation are widely recognized as a new conservation tool that can significantly increase conservation coverage and help achieve the 30×30 target.

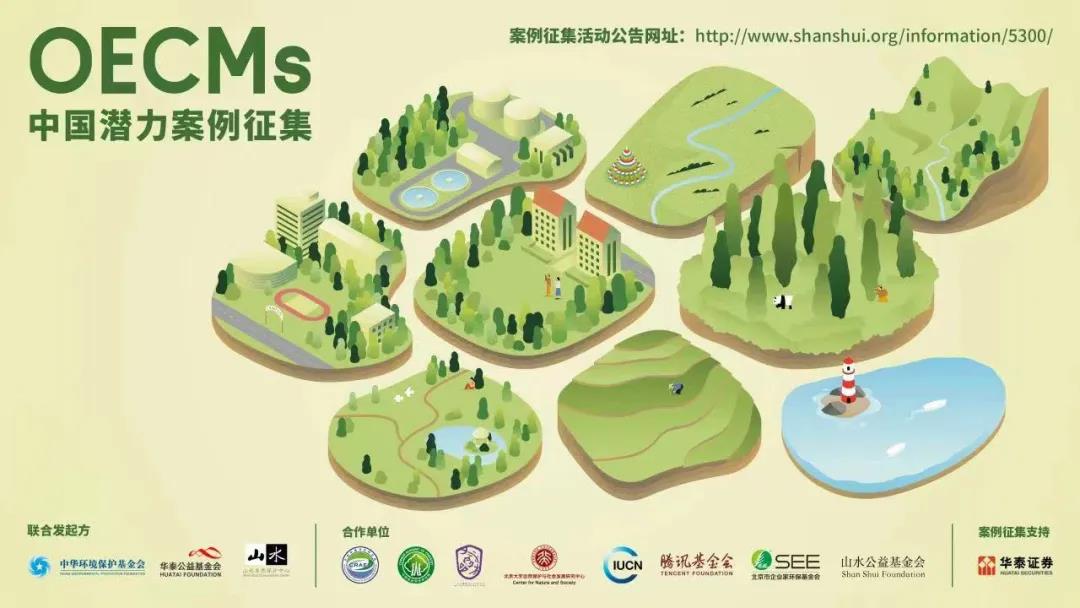

With support from the Department of Nature and Ecology Conservation of China’s Ministry of Ecology and Environment and funding from Huatai Securities, the China Environmental Protection Foundation, Huatai Foundation, and Shan Shui Conservation Center jointly launched an initiative to collect potential OECM cases in China. This initiative aims to gather, synthesize, and showcase exemplary practices and experiences of potential OECMs in China. Through this initiative, we hope to provide a basis and reference for developing localized OECM criteria and guidelines, thereby facilitating the pathways for OECMs in China and promoting the achievement of the 30×30 target.

The initiative received 90 applications from a diverse range of stakeholders, including social organizations, businesses, universities, and farmers’ cooperatives. These applications covered various ecosystems such as forests, wetlands, oceans, urban areas, and farmlands, totaling 1,290 km². They contributed to the conservation of endangered species like the Siberian tiger, giant panda, Yunnan golden snub-nosed monkey, Chinese pangolin, Baer’s pochard, Chinese immaculate treefrog, Chinese horseshoe crab, and others.

Following a rigorous process that included desktop review, expert evaluation, field investigations, and results disclosure, 12 cases, including the Peking University Campus Conservation Area, were selected as “Outstanding Potential OECMs.” Additionally, 34 cases, including Nanjing Olympic Center’s near-natural green space, were identified as “Potential OECMs.” These efforts demonstrate the diverse contributions of Chinese society in the process of China further exercising leadership in the field of global biodiversity governance.

At COP16’s side event, “Exploring Voluntary Commitments by Non-state Actors in Advancing Other Effective Area-based Conservation Measures (OECMs): Insights from China and International Perspectives”, Huatai Securities and the Shan Shui Foundation jointly launched China’s first OECMs special fund – the Non-state Actor OECMs Small Grants. Building on six years of experience with the “One Yangtze River” ecological and environmental protection public welfare project, Huatai Securities will focus on the Yangtze River Basin, selecting projects from potential OECM cases with practical needs and long-term potential to provide small grants and professional capacity building through the fund.

Jillian Campbell, Representative of the UN Convention on Biological Diversity Secretariat, highlighted the crucial role of OECMs in achieving the 30×30 targets, emphasizing the need to focus on management effectiveness, equitable governance, and connectivity in future implementations. Liu Ning, Deputy Director General of the Department of Nature and Ecology Conservation of China’s Ministry of Ecology and Environment, noted that China’s National Biodiversity Strategies and Action Plans (2023-2030) emphasizes innovating OECMs, exploring diverse governance models, and supporting various forms of in-situ conservation of biodiversity from all sectors of society. He expressed his hope that Chinese financial institutions, exemplified by Huatai Securities, will collaborate with professional organizations to conduct more exemplary explorations.

Launched in 2018, Huatai Securities’ “One Yangtze River” initiative promotes biodiversity mainstreaming by supporting community conservation efforts, providing youth ecological education, and fostering the growth of young professionals in sustainable development. By applying ESG principles, it encourages listed companies and financial institutions to participate in conservation. Huatai will leverage potential OECM case studies and the OECMs special fund to support diverse stakeholders’ long-term biodiversity conservation efforts and innovative pilot projects, fostering a multi-stakeholder action system and promoting a collective commitment to building a beautiful China.

About Huatai Securities

Established in 1991, Huatai Securities Co., Ltd. (601688.SH; HKG: 6886; HTSC.LI) played a key role in modernizing China’s securities industry with financial technologies, offering a diverse range of financial services to individuals and institutions. In 2023, the Company achieved an operating revenue of RMB 36.6 billion and a net profit attributable to the parent company of RMB 12.8 billion, solidifying its position as a frontrunner in the Chinese securities sector, and aiming to become a preeminent investment bank with strong footprint in China and global influence.

For enquiries, please contact:

Citigate Dewe Rogerson

Benny Liu Linda Pui

Tel: +86 10 6567 5056 Tel: +852 3103 0118

Email: HTSC@citigatedewerogerson.com