Curtailed Power Costs Renewable Asset Owners up to 30% of their Generating Potential

Soluna Holdings, Inc. (Nasdaq: SLNH) (formerly Mechanical Technology), a developer of green data centers for cryptocurrency mining and other intensive computing, announced today that it is now offering a custom estimating service for clean energy power plant owners and developers looking to reduce costly curtailment problems. The custom Curtailment Assessment is an NDA-protected review of proprietary, project-level data to estimate both lost and recoverable revenue with the addition of flexible offtake of curtailed power by Soluna’s modular data centers (MDC).

“We started as a wind developer, so we know that curtailment can steal up to 30 percent of an asset owner’s power generation/profit potential,” said Soluna Computing CEO John Belizaire. “That’s been accepted as a given. We say it’s now an avoidable cost, and we’re out to show asset owners that they don’t have to watch their margins drain away.”

Curtailment occurs when clean electricity providers, such as solar and wind farms, cannot sell all their power to a congested or over-supplied grid or must sell it at a loss. Curtailment costs power plant owners up to $2 million per year due to a failure to deliver on contracted power purchase agreements (PPAs), the loss of Production Tax Credits (PTC), and Renewable Energy Certificates (RECs).

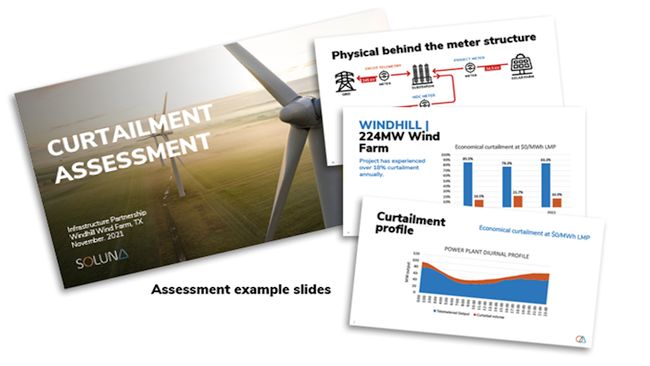

Soluna’s Curtailment Assessment is a groundbreaking, proprietary service that analyzes a producer’s historical data to determine how much additional revenue owners can see by incorporating flexible energy demand on-site from the company’s modular data centers.

Curtailment Assessment Process

Power partners who are interested in receiving a custom assessment can submit data to Soluna for analysis under NDA. Once received, Soluna’s team analyzes the data, develops the custom Curtailment Assessment and a plan to solve the profit bleed. This plan will include a detailed look at the project’s total output, curtailed energy, seasonality and the financial impact of curtailment.

Soluna’s Curtailment Assessment develops options for boosting revenue, including various sized modular data centers that range from 50 MW to 150MW. The data centers are developed behind the meter to add flexible demand that converts curtailed energy into additional revenue. Soluna can develop and build a modular data center within six months.

Renewable Energy Project Owners, Developers, and Asset Managers can schedule a call to initiate their custom Curtailment Assessment here. https://www.solunacomputing.com/curtailment/

“We want to make renewable energy a global superpower, and we will do that by offering our computing centers as an immediately available, cost-effective alternative to battery storage for utility-scale renewable energy plants,” continued John Belizaire.

Having batchable computing capability such as cryptocurrency mining on-site can increase the revenue of a renewable energy project up to 20% to 30%. These on-site scalable data centers consume every excess megawatt that the solar panels or wind turbines aren’t able to sell.

About Soluna Holdings, Inc. (formerly Mechanical Technology)

Soluna Holdings, Inc. (Nasdaq: SLNH) (formerly Mechanical Technology) is the leading developer of green data centers that convert excess renewable energy into global computing resources. Soluna builds modular, scalable data centers for computing intensive, batchable applications such as cryptocurrency mining, AI and machine learning. Soluna provides a cost-effective alternative to battery storage or transmission lines. Soluna Holdings formed when Mechanical Technology, Inc. (MTI) acquired Soluna Computing in 2021. Soluna’s MTI Instruments division manufactures precision tools and testing equipment for electronics, aviation, automotive, power and other industries. Both Soluna and MTI Instruments use technology and intentional design to solve complex, real-world challenges. Up to 30% of the power of renewable energy projects can go to waste. Soluna’s data centers enable clean electricity asset owners to ‘Sell. Every. Megawatt.’

For more information about Soluna, please visit www.solunacomputing.com or follow us on LinkedIn at linkedin.com/solunaholdings and Twitter @SolunaHoldings.

Forward-Looking Statement

This communication contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements reflect management’s current expectations, as of the date of this communication, and involve certain risks and uncertainties. Forward-looking statements include statements herein with respect to the successful execution of the Company’s business strategy. The Company’s actual results could differ materially from those anticipated in these forward-looking statements as a result of various factors. Such risks and uncertainties include, among other things, our ability to establish and maintain the proprietary nature of our technology through the patent process, as well as our ability to possibly license from others patents and patent applications necessary to develop products; the availability of financing; the Company’s ability to implement its long range business plan for various applications of its technology; the Company’s ability to enter into agreements with any necessary partners; the impact of competition, the obtaining and maintenance of any necessary regulatory clearances applicable to applications of the Company’s technology; and management of growth and other risks and uncertainties that may be detailed from time to time in the Company’s reports filed with the Securities and Exchange Commission.

Media Contact: Melissa Baldwin, Melissa@Tigercomm.us, 727-743-3778

Investor Relations Contact: Kirin Smith, ksmith@pcgadvisory.com, 646-823-8656