News flows the past week has centred around BTC’s big flash dip and about how long-term investors are taking the chance to accumulate more BTC. However, no one seems to be talking about the second largest coin, ETH. Is ETH a good buy at these levels?

The rise in DeFi is the single largest contributor towards the demand for ETH in this bull run as ETH is used both as a collateral as well as a fuel to use the ETH blockchain for yield-farming. While other developments like NFTs also contribute to the popularity of ETH, by and large, 90% of the demand for ETH has been for DeFi usage so far. Thus, to study if ETH is a worthwhile investment now, our focus should still be on DeFi, specifically, the trend about DeFi going forward.

ETH, while being the undisputed leader in DeFi, has seen some competition from other blockchains like Binance Smart Chain (BSC) and Polygon (MATIC). Part of the argument against ETH in DeFi use has been its high gas fee and slow speed, which has caused both yield-farmers and protocols to migrate to other cheaper blockchains like BSC and Polygon (MATIC). This resulted in some value from the ETH blockchain moving to other blockchains.

However, as the market started to turn downwards in May, exploits on DeFi projects were getting one too many with projects on other blockchains, while none were observed with those on ETH. BSC, the largest contender, saw the community of its top protocols, Venus (XVS) and Bunny (BUNNY), lose billions of staked funds due to exploits. This trend soon started happening to projects on MATIC as well, with the fastest and largest ever rug-pull (developer running away with yield-farmers’ money) happening to Iron Finance, a project that even sophisticated investor Mark Cuban was openly bullish about. Iron Finance totally collapsed, wiping out billions of investor funds. It is appearing that the very reasons why these projects were successful became the very reason of their failure to take-off. Being cheap and fast allows bad actors to take advantage because it costs a scammer close to nothing to create a new protocol and they are able to get funds out of the protocol before being detected because the blockchain is fast. Perhaps ETH’s higher gas fee and slower speed may be the very reason why exploits there are rare. Because it is more expensive to interact with ETH, projects and users there tend to think more long-term and could be less “degenerate”.

The problems surrounding DeFi exploits caused a market-wide exodus of funds in DeFi projects on both BSC and MATIC in the past two months. The USD Total Value Locked (TVL) in BSC fell from a peak of $30 billion to a low of $10 billion, a loss of 67%, while the BNB token saw a loss in value of 69%. TVL on MATIC fell from a high of $11 billion to $4.3 billion, a 63% loss, while the MATIC token lost 65% at its lowest point during the selloff. Both projects have seen TVL rise back, with BSC clocking around $13 billion and MATIC $5 billion currently. To give a better perspective, lets quote in percentage terms. The TVL for BSC is still 60% lower, while the BNB token price has recovered to $290, a 60% loss from its ATH. As for MATIC, the token price is now around $1.10, which is 55% off from its peak, also a rather good reflection of its 55% TVL loss.

Contrast this with ETH, which saw its price fall 61% from a high of $4,373 to a low of $1,700, when the TVL on protocols run on ETH only fell 42%. At its peak, ETH projects took in an aggregate $117 billion, while they dropped to $67 billion at the lowest point in May, a fall of 42%. However, the price of ETH was hammered down by 61% during that time, falling 20% more than the drop in TVL.

Even though ETH price has recovered from its low, it is still 55% lower than its high, while its TVL has recovered to around $77 billion, around 35% lower than its peak, with the 20% discrepancy is still manifesting. This reveals that unlike the other two competitors, the fall in ETH price is more drastic in proportion to its fall in TVL, which could suggest that the selling in ETH is overdone. ETH, a leader in the smart contract blockchain place, which ought to give it a price premium, is now seemingly trading at a disproportionate price discount to TVL as compared with its peers. This could thus mean that either ETH is undervalued, or that the other two blockchains are overvalued.

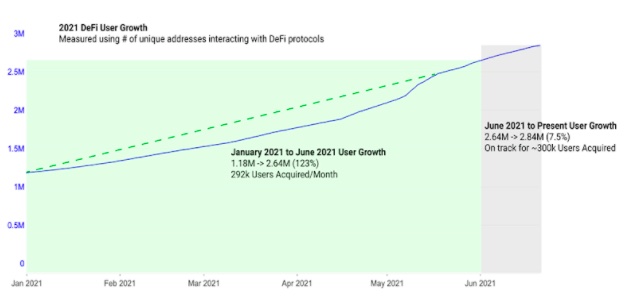

To ascertain if the few DeFi-blockchains are likely overvalued or undervalued, let us examine the DeFi adoption in the past year. DeFi adoption has been taking off in a gradual way since the early part of 2021, as can be seen in the below chart. The month-on-month growth of DeFi users had been consistent, with 292,000 new users registered every month since Jan 2021. In June, despite the market fallout, the number of new DeFi users did not drop, in fact that number actually went up to 300,000. This suggests that growth in DeFi adoption has not only not receded, but it actually picked up pace, which shows an aggressive growth trajectory. Valuation in an industry which is growing aggressively should have a premium, which means they ought to command premium valuation. Hence, this in no way suggests that a lower valuation estimate should be warranted for blockchains doing DeFi. In this regard, ETH is not overvalued. ETH is in fact, rather undervalued, since ETH is now also on track with some major upgrades as imminent as July.

The massive fall in ETH then could be due to greedy investors taking on high leverage positions during the hype of the impending upgrade, only to suffer from huge liquidations when the market turned, which started a spiralling effect as margin liquidations sent prices lower which then resulted in more margin liquidations on other investors which started a cascade of price fall. With price settling into consolidation after the bulk of the liquidation done, investors looking for value may do well accumulating ETH when its price is still currently undervalued.

The key risk event for ETH of course could be the failure of ETH2.0. However, with ETH founder, Vitalik Buterin, already having issued a pre-emptive warning to not expect a smooth transition until year 2022, investors have been mentally prepared and reaction towards any implementation delay will not be drastic.

It thus seems that there is more room for upside surprise should the key upgrade manage to yield better-than-expected results in fee reduction as well as in reducing the supply of ETH in the market. ETH looks to me a good buy at current level of around $2,000.

About Kim Chua, PrimeXBT Market Analyst:

Kim Chua is an institutional trading specialist with a track record of success that extends across leading banks including Deutsche Bank, China Merchants Bank, and more. Chua later launched a hedge fund that consistently achieved triple-digit returns for seven years. Chua is also an educator at heart who developed her own proprietary trading curriculum to pass her knowledge down to a new generation of analysts. Kim Chua actively follows both traditional and cryptocurrency markets closely and is eager to find future investment and trading opportunities as the two vastly different asset classes begin to converge.