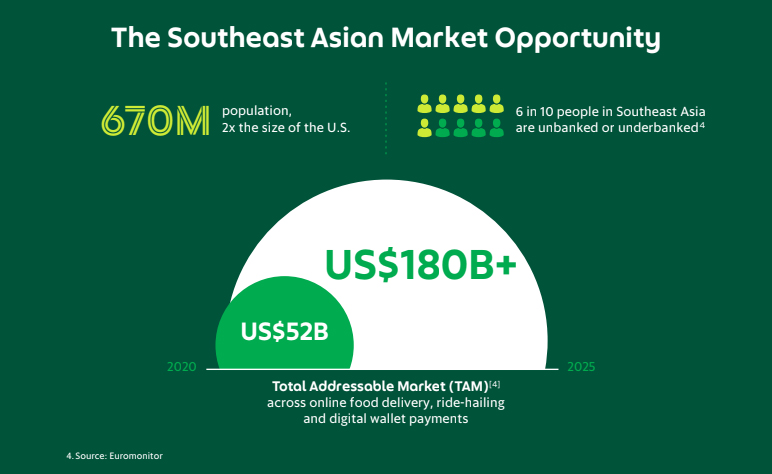

Grab Holdings Inc, Southeast Asia’s leading superapp, today announced it intends to go public in the U.S. in partnership with Altimeter Growth Corp. in what is expected to be the largest-ever U.S. equity offering by a Southeast Asian company.

The combined company expects its securities will be traded on NASDAQ under the symbol “GRAB” in the coming months.

The proposed transactions value Grab at an initial pro-forma equity value of approximately US$39.6 billion at a PIPE size of more than US$4.0 billion and will provide Grab with approximately US$4.5 billion in cash proceeds.

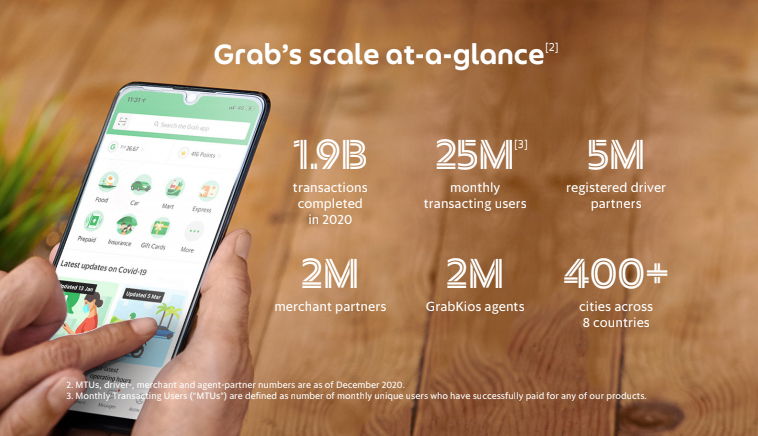

Grab is a superapp dedicated to serving everyday needs and everyday entrepreneurs. It offers services across mobility, deliveries, financial services and more, in an all-in-one app.

“It gives us immense pride to represent Southeast Asia in the global public markets. This is a milestone in our journey to open up access for everyone to benefit from the digital economy. This is even more critical as our region recovers from COVID-19,” said Anthony Tan, group CEO and co-founder of Grab.

“As we become a publicly-traded company, we’ll work even harder to create economic empowerment for our communities, because when Southeast Asia succeeds, Grab succeeds.”

Grab’s decision to become a public company was driven by strong financial performance in 2020, despite COVID-19. Grab posted GMV of approximately US$12.5 billion in 2020, surpassing pre-pandemic levels and more than doubling from 2018.

The company is also currently the category leader in Southeast Asia for its core verticals, accounting for approximately 72% of total regional GMV for ride-hailing, 50% of total regional GMV for online food delivery and 23% of regional TPV for digital wallet payments in 2020.

Grab believes it is perfectly positioned to serve the needs of consumers, merchants and drivers in Southeast Asia through its superapp strategy. It offers an ecosystem of complementary services, addressing high-frequency, everyday needs, all through one app.

Grab’s journey to becoming a U.S.-listed public company will be facilitated by a definitive business combination agreement between Grab and Altimeter Growth, a special purpose acquisition company.

Pursuant to the proposed transactions, Altimeter Growth and Grab will become wholly-owned subsidiaries of a new holding company. The combined company is expected to have an equity value on a pro-forma basis of approximately US$39.6 billion. – BusinessNewsAsia.com