The renminbi (RMB) has become a topic of debate in more than a fifth (22%) of company boardrooms around the world, just five years after China began to liberalise its currency, a new survey from HSBC Commercial Banking shows.

Outside Greater China about a quarter of senior management teams in Singapore, Malaysia, Germany and the UAE have discussed the RMB as a business enabler, according to the poll of more than 1,600 decision-makers in 14 countries and territories.

Just under a fifth have done so in the Anglophone nations of Australia, Canada, the UK and the US.

“Corporate use of the renminbi reached a watershed last year,” said Simon Cooper, Chief Executive of HSBC Commercial Banking. “The currency began to depreciate against the dollar, reversing a multi-year trend and marking a new phase in the liberalisation process. Whereas many companies outside China used

to see RMB adoption as a somewhat niche opportunity to gain first mover advantage, they’re now adjusting to it becoming a mainstream tool. If you’re doing business with China, the world’s biggest trading nation, you have to think about doing business in China’s currency.”

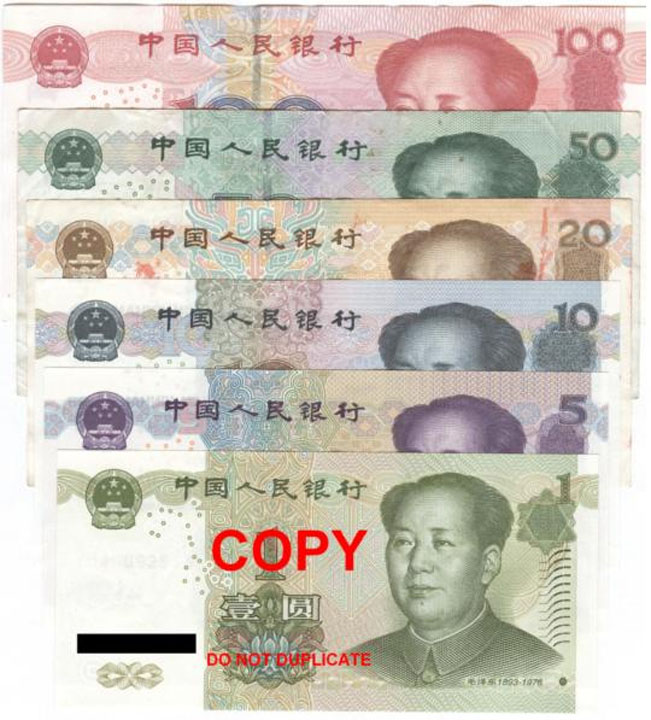

RMB usage has soared since China started to dismantle barriers limiting cross-border transactions in 2009. In late 2014 it became the fifth most-used currency for global payments, according to data from SWIFT, after the value of RMB payments more than doubled in a year.

Having climbed by 8% against the dollar from January 2011 to January 2014, the RMB has declined by about 3% since the start of this year as the pace of US economic growth accelerated.

Over the past six months it has appreciated against currencies including the euro, pound sterling and yen.

HSBC commissioned a similar 11-market survey in 2014, adding Brazil, Malaysia and South Korea this year.

When comparing responses from 2015 and 2014 across the original 11 markets, slightly fewer businesses now expect to gain financial advantages from doing business with China in RMB – 44% versus 47% in 2014. Similarly slightly fewer expect to gain relationship advantages from conducting their China business in RMB – 47% versus 49%.

That said, more than half (54%) of all the businesses surveyed this year expect to increase their cross-border trade with China in the next 12 months.

Of the companies outside Asia with the highest expectations of China trade growth, such as those in the US (65%), the UK (64%), the UAE (71%) and Germany (60%), a fifth to a quarter said their management teams have discussed the RMB as an opportunity.

Moreover, 27% of firms across all 14 markets are not using the RMB today said they plan to use it in the future.

“It’s interesting to see that views about the RMB’s future impact have diverged since 2014,” Cooper said.

More businesses in the UK, the UAE, the US and Singapore now think the RMB will be used to settle non-China trade within five years, just as dollars is used today for transactions that don’t involve US counterparties. Conversely, we’ve seen businesses become more hesitant in Taiwan and in Germany. For me, this is another sign of the RMB maturing as a global currency; one that fluctuates in value and one for which demand can be

influenced by developments outside mainland China.”

During 2014 the Chinese authorities made a number of regulatory changes to make the RMB easier for companies to use and more responsive to market forces; including the introduction of two-way cross-border sweeping and a widening of the onshore trading band against other major currencies. Clearing banks were mandated for 10 countries including France, Canada, Thailand, Qatar and the UK to help spur the development of offshore RMB hubs.

For its 2015 survey HSBC polled more than 1,600 decision-makers from Australia, Brazil, Canada, mainland China, France, Germany, Hong Kong, Malaysia, Singapore, South Korea, Taiwan, the UAE, the UK and the US who represent companies that conduct international business with or from China.